There’s hope that Biden may issue an executive order forgiving $10,000+ of each person’s outstanding student loans. I dug up two opposing arguments on this topic that we can all learn from.

Arguments Against Forgiving Student Loan Debt

This is a crude and borderline propaganda-like video but it’s still insightful.

This is a great Twitter thread written by Carlton Galbreath:

“My wife and I have over a quarter million dollars of student debt

And I’m a professor

And I am politically left/progressive on most things

So please understand I’m speaking strongly against my own self-interest when I say:

THIS IS A TERRIBLE IDEA

A thread

Schumer saying Biden can cancel first $50,000 in student debt via executive order. And will do so in first 100 days. This will change so many lives. https://t.co/nkWZykLJVE

— Tom Winter (@WinterForMT) November 7, 2020

Problems:

– Further exacerbates class divide

– Stokes legitimate fears of @TheDemocrats building a welfare society that disproportionately benefits their voters

– Shifts accountability away from institutions

– Punishes anyone who forwent school or aggressively paid off debt

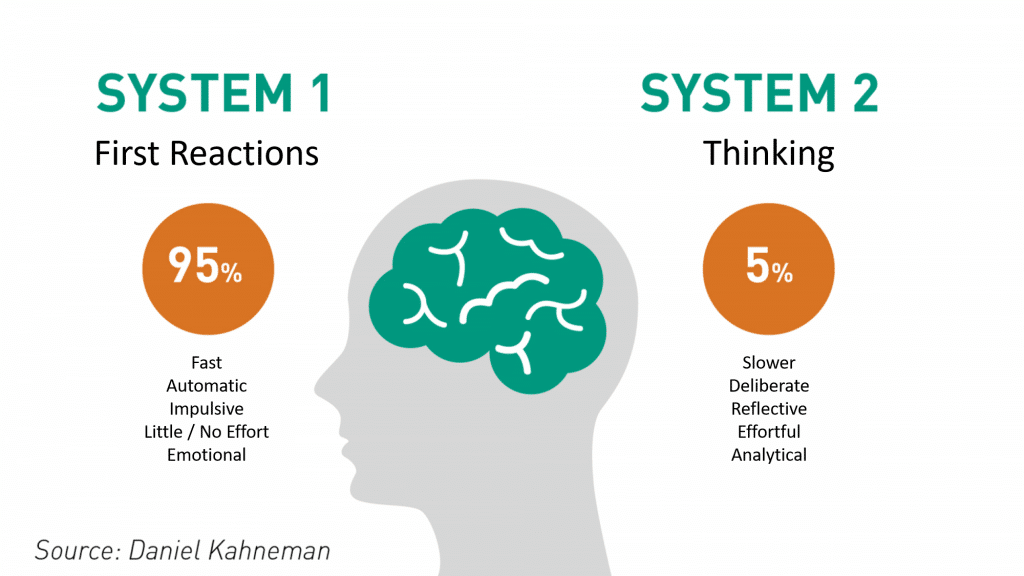

Americans are not stupid

AND are clearly fed up with @ewarren and the “pizza for lunch every day and unlimited recess (but only for our constituents)” faction of the left

Treating them like they are

"I've saved all my money. [My daughter] doesn't have any student loans. Am I going to get my money back?"@eWarren: "Of course not."

"So you're going to pay for people who didn't save any money and those of us who did the right thing get screwed." pic.twitter.com/eqK7o4Cl9Q

— Washington Examiner (@dcexaminer) January 23, 2020

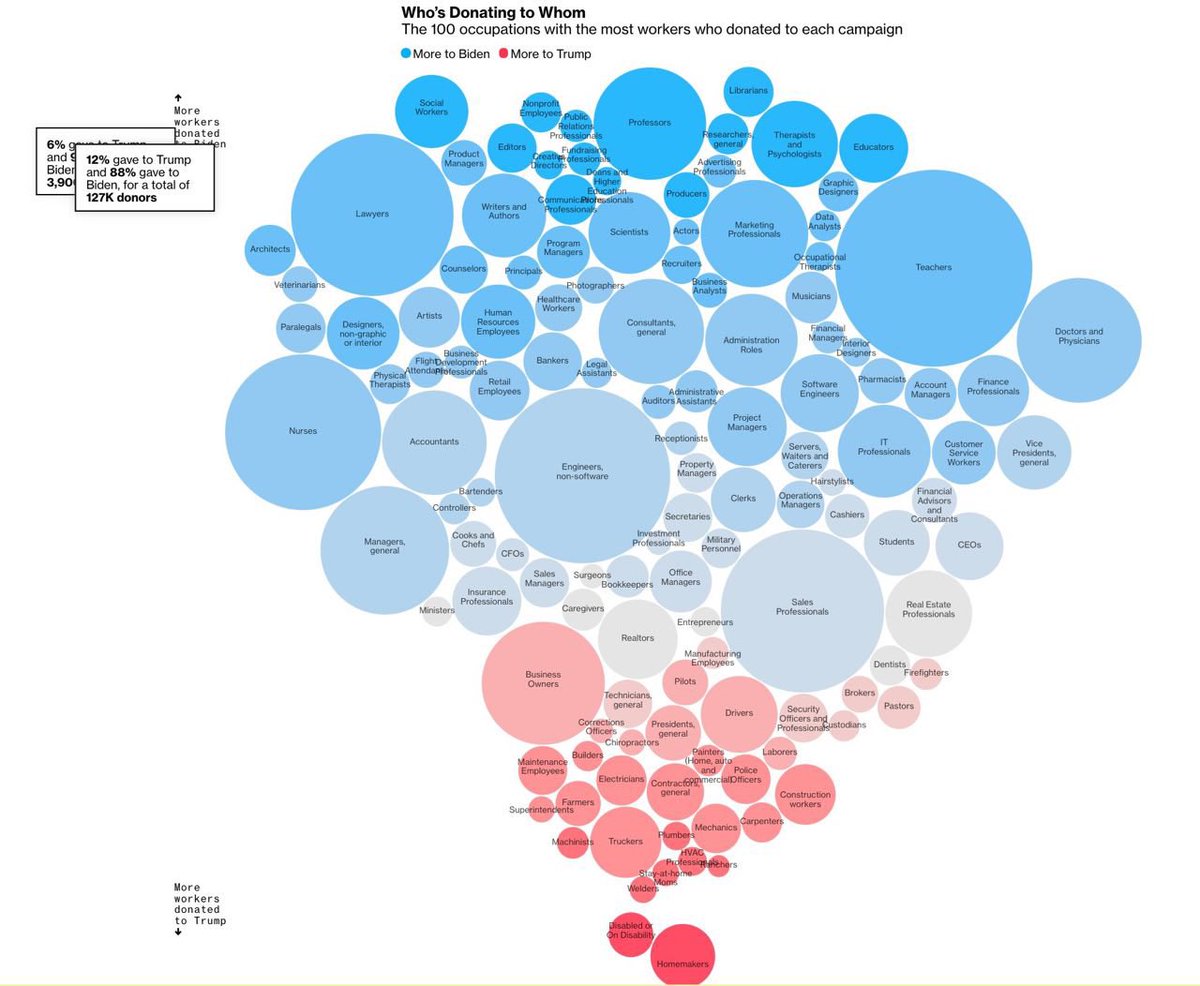

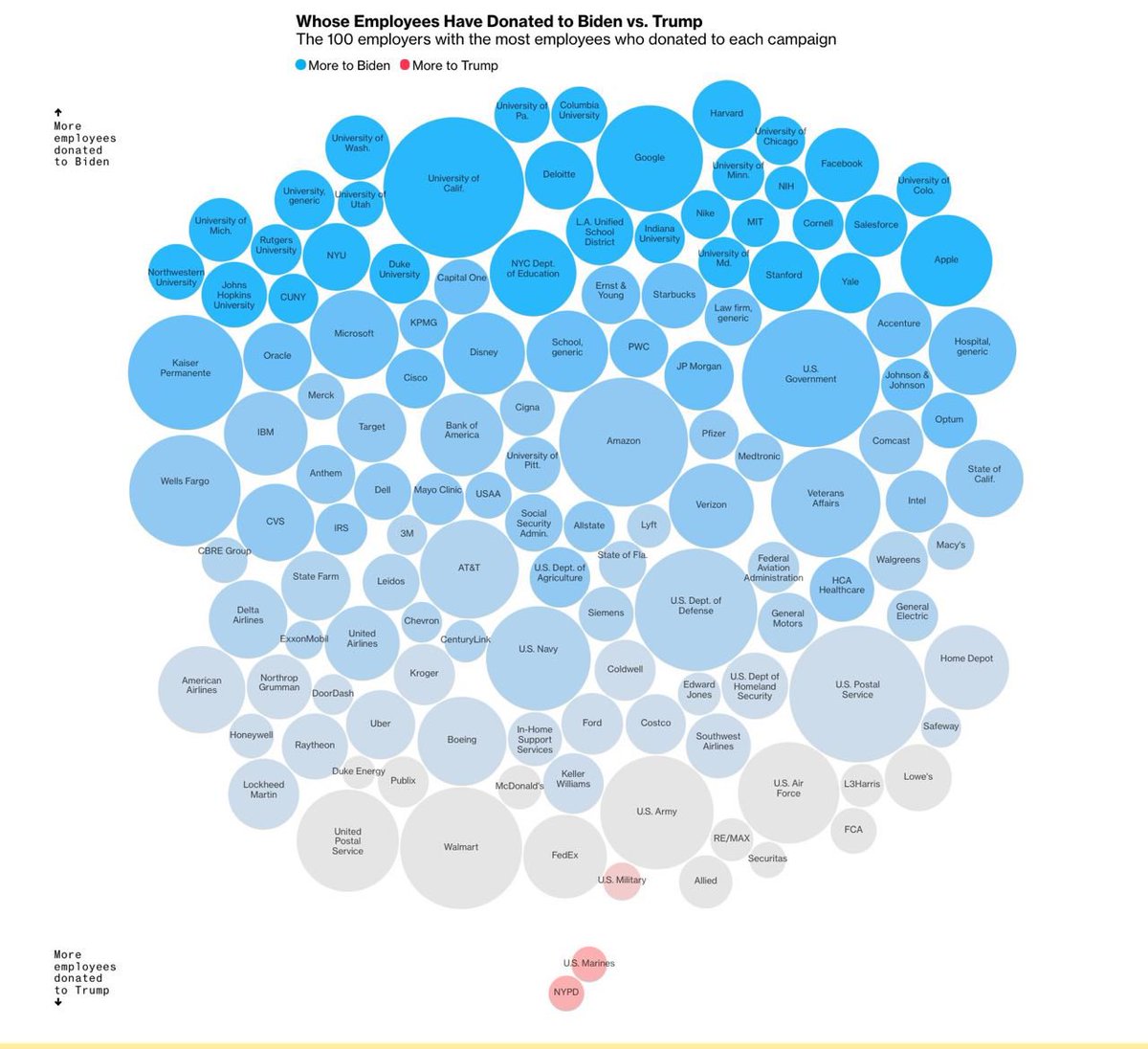

Just in case you doubt the self-interest here

Now, I’m gonna start to lose folks who are cheering so far:

This doesn’t have to be intentional favoritism to still be favoritism

If you think this is a conspiracy or large scale pay-for-votes/quid pro quo, I’m not your guy

Assume best intent – good hearts, bad ideas

Now, it’s also true that student debt and the cost of college are HUGE systemic problems that need to be addressed – over the last decade and change, they:

– Outstripped inflation by orders of magnitude (25%+ increase in cost, mostly going to amenities and administrators)

– Grew to over $1.6T (more than tripled)

– Became undischargeable in bankruptcy (Bush administration bill that I’m saddened to learn @JoeBiden championed on the left)Resources/great follows to learn more about all this:

@profgalloway & @EricRWeinstein https://www.theguardian.com/us-news/2019/dec/02/joe-biden-student-loan-debt-2005-act-2020

Now, to lose even more of the folks who are cheering so far!

I can’t stand ppl who lambast those trying to solve problems without themselves proposing viable alternative solutions, so here’s my attempt to “be the change I wish to see in the world”

Solutions I endorse/propose, ordered by cost efficiency & relevance to this specific problem:

– Make student debt dischargeable in bankruptcy

– Decrease hurdles (yrs, min pmt) for public service loan forgiveness

– Make it illegal to charge a higher interest rate (prime rate) to the American ppl for student debt than you do to the banks that have repeatedly sold us down the river and been bailed out by our tax $$$

– Fortify & advertise student debt safety nets (income-based repayment, no negative credit reporting, etc)

Make these opt-out rather than opt-in

– Pass UBI that would put money in the pockets of ALL Americans to spend on student debt – or whatever else is more needed – without punishing or preferencing any one group

@AndrewYang ran on this platform, addressed student debt directly with @joerogan

Create a public service:

– Option in the vein of FDR’s Civilian Conservation Corps, OR

– Requirement (not necessarily military, btw) in the vein of South Korea, Israel, Singapore, Switzerland ( @nntaleb)

That provides free public higher ed and/or loan discharge upon completion

There are many other great ideas I’m sure that could help address this problem, and I highly doubt there’s a single silver bullet

To my 12.7 followers and anyone else who happens to read this, I’d love to hear your solutions, and welcome any critiques of what I’ve written here

PS – This thread hasn’t addressed how to solve the important, related, systemic, tractable problems of:

– Rapidly increasing college costs

– Requiring college degrees for work that doesn’t actually require a college degree

@peterthiel @thielfellowship do good work on this

PPS – I’d like to steel-man (thanks for this concept @SamHarrisOrg) a valid critique of my above line criticizing the “‘pizza for lunch every day and unlimited recess (but only for our constituents)’ faction of the left”

The right does it too, it’s called corporate socialism

Matter of fact, the parties are really the same – as I like like to say, the only group that never loses the @WhiteHouse is @GoldmanSachs

@TheDemocrats and @GOP really serve:

– Banking

– Insurance

– Pharmaceuticals

– Oil & gas

– Military-industrial complex

*Institutions > ppl*

Now first, most of these institutions are not inherently our enemies- we need efficient, robust capital markets, innovative medical/drug research, affordable energy, a strong military, etc

They’re just way overpowered

What are the results?

– 2008 financial crash was caused by them, they get bailed out by taxpayer dollars, but unlike any other successful investment we the people see 0 return on investment and the gains are just handed back to the banks (also no criminal convictions)

– @realDonaldTrump (actually he was just a convenient smoke screen/distraction for the @GOP) passes a tax bill that lowers corporate taxes, increases middle class tax burden

– COVID relief dollars go mostly to corporations, not the american ppl

– COVID relief dollars paid for by the @federalreserve printing money – ie “taxation by inflation” – again a burden borne primarily by main street, not wall street

Oh and the kicker?!

There’s a good chance we’re about to repeat 2007/2008 (a crisis caused primarily by Collateralized Debt Obligations – CDOs)

With govt bailouts going to companies that are either mismanaged or becoming rapidly obsolete like @PartyCity @AMCTheatres @CarnivalCruise

In the form of Collateralized Loan Obligations (CLOs)

Which of course also bail out banks at the same time https://www.theatlantic.com/magazine/archive/2020/07/coronavirus-banks-collapse/612247/

THEY THINK YOU’RE SO DUMB AND EASY TO ROB THAT THEY DON’T EVEN TRY TO HIDE IT!!!

#MATH (Make America Think Harder) – another reason I love the humanity and decency and high opinion of the American people that @AndrewYang combines so well

So @ewarren and her ilk should at least be given credit for:

– Being open and upfront about the robbery

– Wanting to commit the same crime IN FAVOR of the American people (at least those who voted for them), for once

I’d just prefer not commit the crime at all.”

The Argument For Forgiving Student Loan Debt

Written by Bharat Ramamurti:

Broad student loan debt cancellation via executive order is good economics and politics. A thread (with lots of data). 1/

First, it’s important to remember that *a lot* of people have student loan debt — 45 million or so. For context, 25 million people benefit from the EITC and 38 million people get SNAP. Fundamentally, one of the benefits of debt cancellation is that it helps a lot of people. 2/

Canceling student loan debt has positive income effects. The median borrower making payments has a monthly payment of more than $200. Canceling debt could reduce or eliminate those payments — which is like sending those people a check every month. 3/

Student loan debt cancellation also has positive wealth effects. Student debt loads are part of the reasons we’re seeing declining home ownership and small business formation rates. Canceling the debt will have mean more jobs and growth.

4/ The impact of student loan debt on small business formation, by Brent W. Ambrose; Lawrence R….

Small businesses are the backbone of the U.S. economy and account for approximately one-half of the private-sector economy and 99% of all businesses.

One study has found that canceling all debt would have a big stimulative effect. The impact would be less if less debt were canceled, but debt cancellation one of the relatively few ways to really stimulate the economy without Congress. 5/

http://www.levyinstitute.org/publications/the-macroeconomic-effects-of-student-debt-cancellation

The latest data and research also show that broad debt cancellation will help narrow the racial wealth gap.

6/ Student Debt Is a Racial Equity Issue. Here’s How Mass Debt Relief Can Address It. – Roosevelt…

$75,000 in student debt cancellation would increase household wealth, help close the racial wealth gap, and boost our struggling economy.

Won’t people be taxed on their canceled debt? No, there are several ways to avoid that, including:

-Deem forgiveness as a disaster payment relating to Covid under IRC 139

-Deem it a qualifying scholarship under IRC 117

-For insolvent taxpayers, exclude under IRC 108

7/

For those concerned about “targeting” student debt cancellation, you can vary the amount of debt cancelled by income level, should you want to. If you’re concerned it won’t help people who never attended college, you could pair it with executive actions that do that.

8/

Some say debt cancellation isn’t well-targeted. Compared to what? Other approaches to provide big stimulus will require Congress, and if that requires negotiating with a R Senate, debt cancellation is likely to be more targeted than the package emerging from those talks.

9/

For example, is it better to do $1 trillion in debt cancellation via executive order or do $500B in child allowances (good!) with another $500B in regressive tax cuts (bad!) to get Republican support? That’s the relevant comparison.

10/

Finally, the politics. First, recall that Trump was so freaked about the popularity of broad debt cancellation that he directed his staff to come up with his own plan.

11/ Eyeing populist challenge from the left, Trump seeks plan to tackle student debt

Aides have failed to come up with proposal to counter Democrats’ expansive plans.

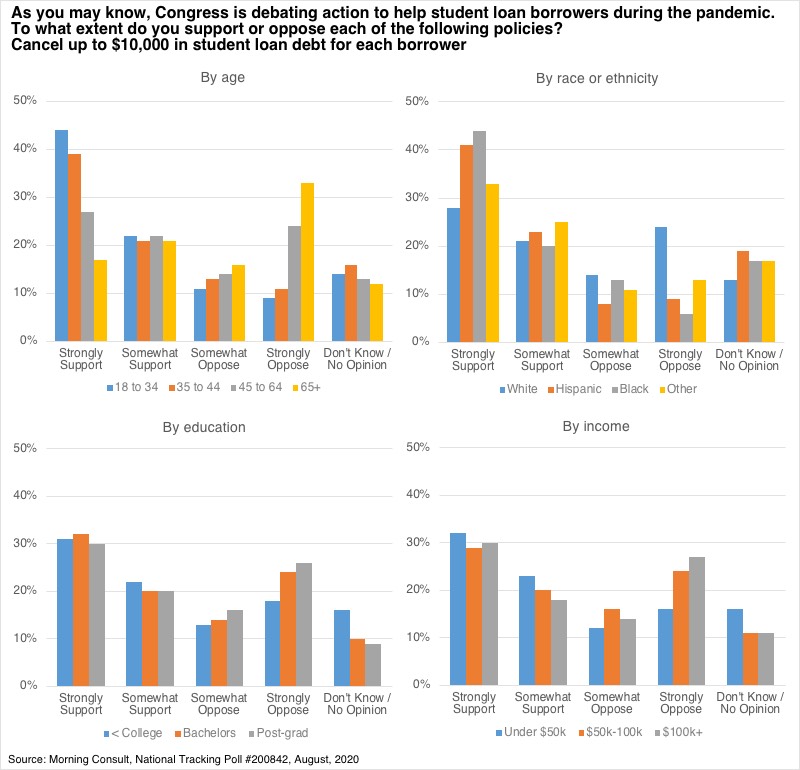

Trump’s panic is borne out by polls, which shows strong majority support for debt cancellation — including from those who’ve never had student debt. (Perhaps the average American is less resentful than the median Twitter commentator.)

12/ Elizabeth Warren’s plan to cancel student debt is popular with voters, survey finds

The majority of American voters support Elizabeth Warren’s student debt cancellation proposal — even those who’ve never taken out loans themselves.

And here’s polling data by demographic. Debt cancellation has the highest approval among people making under $50k/year and among people who don’t have a college degree (many of whom have debt because they didn’t complete college or because they’re co-signing for their kids).

The bottom line is that broad debt cancellation via executive order is popular, economically potent, and — most importantly — life-changing for millions of Americans struggling through this crisis. We can’t let the perfect be the enemy of the good. END

Want To Go Deeper On This Topic?

I recommend watching this video: